See how your portfolio systems stack up across reporting, NOI, and financial resilience in one clear score that reflects how prepared you are for your next lender review or capital event.

Who this is for

This is for people who sign off on portfolio decisions and feel the strain when lenders, investors, or boards start asking hard questions about the numbers.

This is designed for teams who need repeatable reporting and clear portfolio decisions, not one-off analysis.

Roles This Helps Most

- Owners, principals, and family offices with growing CRE portfolios

- CIOs, COOs, and Heads of Asset Management

- Portfolio managers, operators, syndicators, and investment firms responsible for performance and lender relationships

Portfolio Types We See Most Often

- Multifamily and mixed-use portfolios requiring dedicated asset management

- Office, retail, industrial, and specialty assets

- Portfolios where ‘just one more spreadsheet’ is no longer a real solution and every refinance, covenant test, or IC request feels like a fire drill.

What you get

You'll get a comprehensive one-page portfolio systems risk snapshot that you can share with your team and use as a starting point for fixing the right problems first.

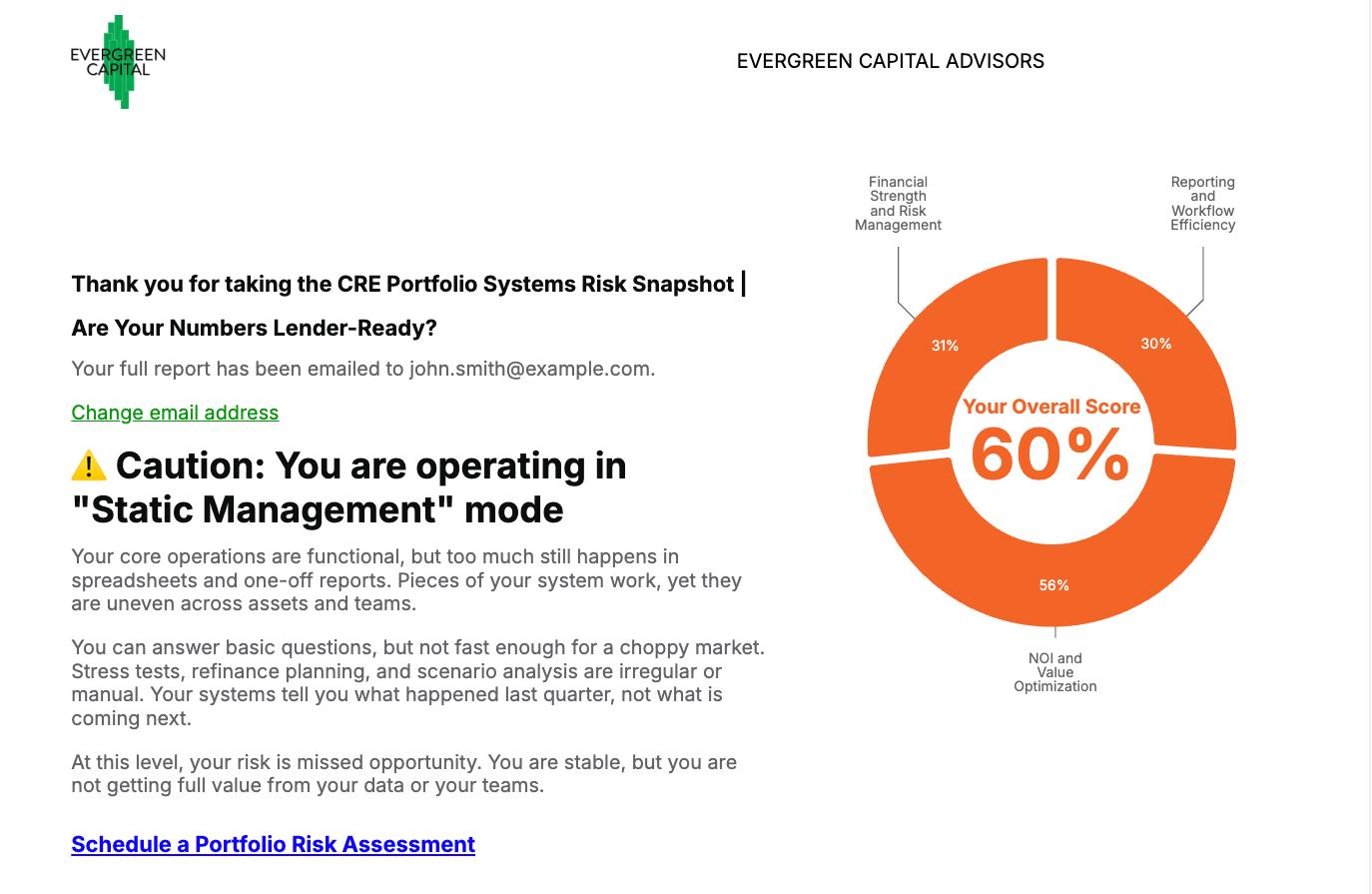

Clear Overall Portfolio Systems Scorecard

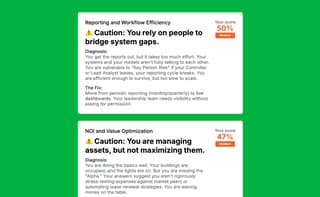

Results and Action Items by Individual Category

View separate scores for Reporting, NOI and Value, and Risk, so you can see exactly where your systems are strong and where they are fragile in the eyes of a lender.

90-Day Fixes Before Your Next Lender Review

Get tailored 90-day suggestions so you can pick one or two realistic fixes that tighten your lender story, instead of another long wish list that never gets implemented.